People are the greatest asset on the journey towards success.

Advocates, partners and trusted advisors. Meet the EM Advisory Team.

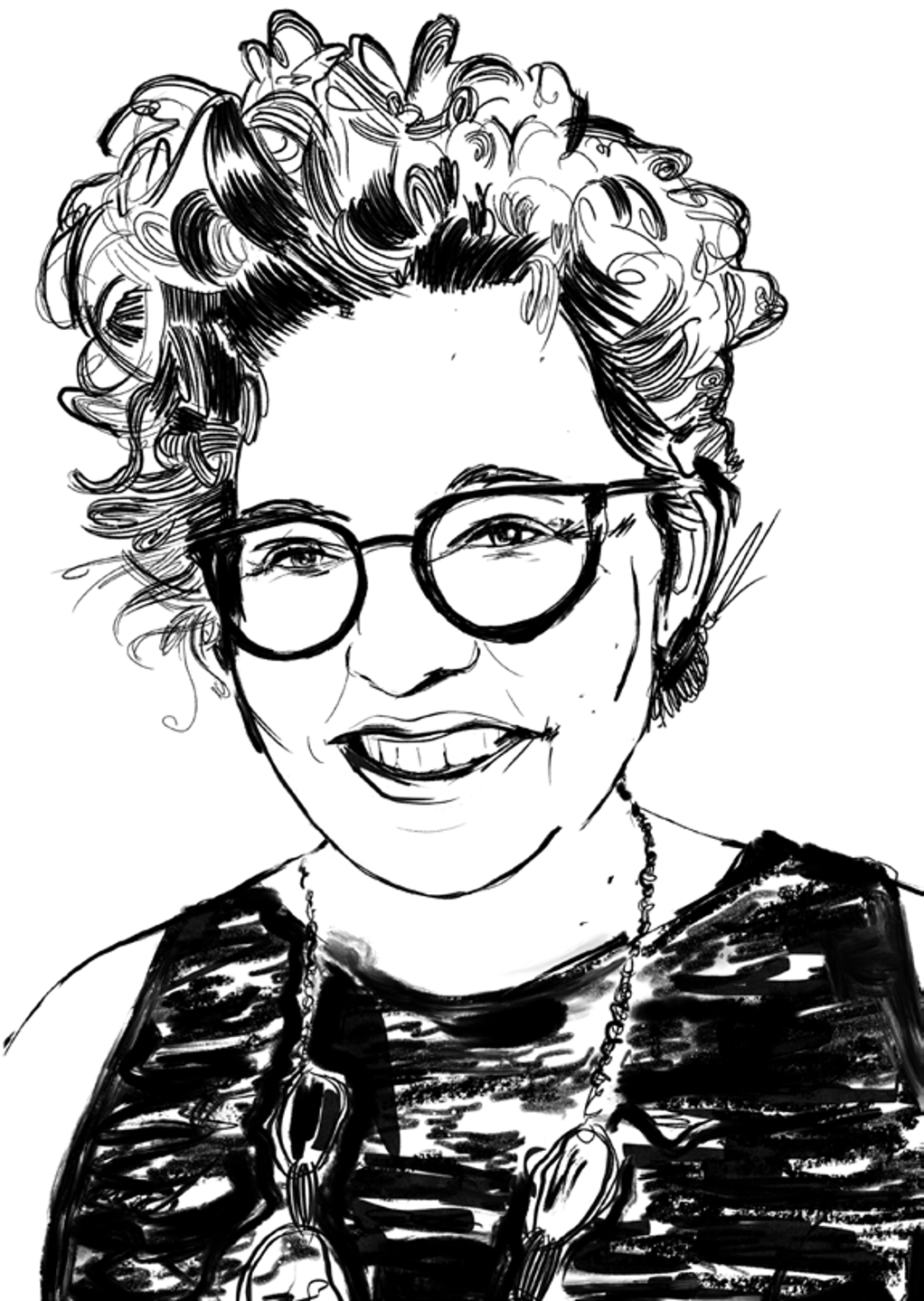

Natasha MandieManaging Director

Natasha Mandie is the Founder and Managing Director of EM Advisory, with over 25 years’ corporate advisory and investment banking experience specializing in mid-market listed and private transactions.

Renowned for her energy, insight and ability to achieve results, Natasha brings skills in strategic negotiation, capital raising, M&A (both buy and sell-side), strategy development and change management, with extensive business networks. She thrives in uncertain and ambiguous situations. She is also a Non-Executive Director of various technology and not-for-profit companies.

Natasha was previously a Director at Credit Suisse in Corporate Advisory Solutions. Natasha joined Credit Suisse as part of their acquisition of the Hindal Group in May 2008, where she was a Shareholder and Director. Natasha started her career with Macquarie Bank in Equity Capital Markets.

Philip GoldhahnDirector

Philip has over 10 years’ experience in M&A advisory across Europe and the UK.

Working with financial sponsors, start-ups, and publicly listed corporations, both on the sell- and buy-side, Philip has a breadth of experience in end-to-end process management, deal structuring and execution.

Prior to joining EM Advisory, Philip was a VP at Carlsquare in Germany where he focused on technology, consumer, and business services transactions.

Oswald FernandesVice President

Oswald brings over 10 years’ experience in M&A, private equity and venture capital advisory.

Oswald is a keen student of business, with an interest in growth drivers, and how business models can be translated to other industries and geographies. With extensive experience across India, the Middle East and Australia, Oswald brings a broad perspective on how businesses can scale, as well as how M&A and capital raisings can support this growth.

Gayathri ShankarAssociate

Gayathri brings more than 5 years’ experience across corporate strategy, business finance and corporate advisory. Gayathri is a Chartered Accountant and has completed two levels in CFA.

She enjoys working with high growth businesses. Her experience in fashion and the retail industry have helped her gain in-depth knowledge of business operations, and develop her core expertise in financial analysis and modelling.

Christian IturbeAssociate

Christian brings four years of experience across corporate finance and public practice accounting.

He enjoys applying his strong understanding of accounting and valuation principles to add value in business analysis, strategy and modelling, particularly in the context of M&A transactions.

Eudes LacazeAnalyst

Eudes brings over two years of experience in equity fundraising advisory across France and the UK.

He has a keen interest in high-growth tech companies, helping them achieve maximal value through strategic capital raises and insightful business analysis. Previously, he spent over a year in mid-market Private Equity.

Anna LeggCFO

Anna is an experienced finance executive and company secretary with over 25 years of experience in financial reporting, management and analysis across a wide range of industries including Fin Tech, Biotech, Banking and Finance and Import/Distribution in public, private and government arenas.

Anna is passionate about understanding key business drivers and solving problems. She has an eye for key details and enjoys providing financial insights. Her previous roles include Chief Financial Officer and Company Secretary at an ASX listed biotech, Financial Analyst at Australia Post and CFO of an early version of Touchcorp Ltd.

Kylie FaveroPractice Manager

Kylie is an experienced administrator, having provided executive level support across a number of industries including finance, logistics and technology, in both Australia and the UK.

Kylie enjoys supporting others to achieve their best, always seeking to find solutions to challenges with a focus on continuous improvement.